© 2023 Auto/Mate, Inc. All Rights Reserved.

Guest blog by Todd Stewart, CSO, Dealer Wizard, LLC

One of the core challenges for automotive retail dealers continues to be new vehicle margin compression. This is certainly not a new topic, evident by the amount of discussion and debate it has sparked between manufacturers and dealers over the past several years, especially in national dealer council forums.

One of the core challenges for automotive retail dealers continues to be new vehicle margin compression. This is certainly not a new topic, evident by the amount of discussion and debate it has sparked between manufacturers and dealers over the past several years, especially in national dealer council forums.

One of the causal factors driving margin compression includes a narrowing gap between factory wholesale cost and MSRP. No matter the manufacturer, there are myriad examples of vehicle nameplates having a spread of $300 to $500 between wholesale and retail pricing, almost forcing a one-price selling strategy on certain models.

It’s also apparent that some manufacturers have reduced margins and repurposed the dollars to fund monthly objective-based dealer cash programs. This pressure to “hit-the-number” (objective) every month further exacerbates deep discounts and the loss of margin.

Some dealers are of the mindset that volume-based programs spur price wars in markets, giving way to a cannibalization environment, with like franchised dealers eating into each other’s profits. Another major contributing factor to margin compression includes a consumer that is armed with information, specifically retail and wholesale pricing that they have gleaned online. With a quick Google search, any consumer can retrieve not only retail and wholesale pricing, but even holdback information. The following link provides a great example:

https://www.car-buying-strategies.com/dealer-invoice/ford-f-150-prices.html

What other product or business sector has this level of consumer transparency when it comes to wholesale product cost? The answer is simple: None.

So how are dealers combatting margin pressure? The majority of dealers that we speak to are maximizing their F&I sales, deploying a savvier approach to fixed operations marketing, investing more in employee training and adapting new technologies. One strategy not mentioned that warrants more attention is equity mining and the numbers prove it. Without question, a dealer’s second largest asset behind their team is their owner base. Dealer Wizard, one of the pioneers in equity mining, provides an intuitive and cost-effective software solution to help dealers shepherd their owner base. The cloud-based application automatically analyzes the full scope of the dealer’s DMS, as well as daily service drive visitors that are in a positive equity position or have minimal lease payments remaining. Dealer Wizard channels lead alerts to dealership team members through their dashboard, as well as direct text messages to user smart phones.

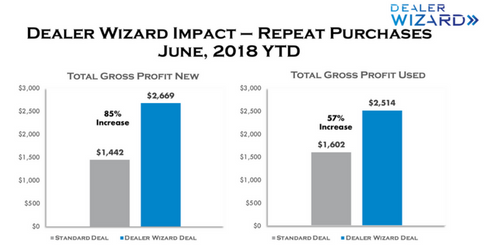

On average, dealers retailed an incremental 156 new and used vehicles utilizing Dealer Wizard’s solution in 2017. Anecdotally, dealers have always told us that their strongest grosses are derived from repeat purchasers. The following Dealer Wizard metrics validate what our clients are telling us (source: May, 2018 YTD DW client platform average results / DW deals vs. Non-DW Deals).

Dealers across the country are investing an average of $676 per new unit retailed in advertising, or 7.9 percent of total gross (source: NADA 04/2018 YTD). Conversely, dealers capitalizing on equity mining are outlaying less than one-quarter of that NADA average, or $152 per unit, to sell a car through the Dealer Wizard solution.

The automotive retail landscape is evolving at warped speed, but margin pressure is one topic that will remain constant. Dealers that optimize their entire dealership operation and cultivate their owner base through equity mining are going to be better positioned to compete in today’s marketplace.

Dealer Wizard, LLC, a division of Service Group, was established in 2011 in Tampa Florida. In April 2018, Auto/Mate announced a full DMS integration with Dealer Wizard. Dealerships that utilize both Auto/Mate’s DMS and Dealer Wizard’s suite of equity mining will benefit from real-time data exchange between the two systems. For more information, please contact Todd Stewart, Dealer Wizard CSO at (214) 707-7004 or [email protected].